Disclosure

This content is provided for general informational purposes only, and is not intended to constitute investment advice or any other kind of professional advice. Before taking action based on such information, we encourage you to consult with appropriate professionals. We do not endorse any third parties referenced within the aforementioned article. Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable. In addition, past performance is no guarantee of future results. There is a possibility of loss. Historical or hypothetical performance results are presented for illustrative purposes only.

You can have multiple Roth IRAs, but know these limits first

Having multiple Roth IRAs is possible and can diversify your investment opportunities and flexibility. Three or more is only helpful in select situations, and most people are set with one traditional IRA and one Roth IRA.

What's Playbook? We're your friendly step-by-step app for growing your money and minimizing taxes so you can live the life you want, sooner. Learn more

Key takeaways:

- You can have multiple IRAs – whether Roth or traditional IRAs – as long as you meet eligibility requirements for contributing to Roth IRAs.

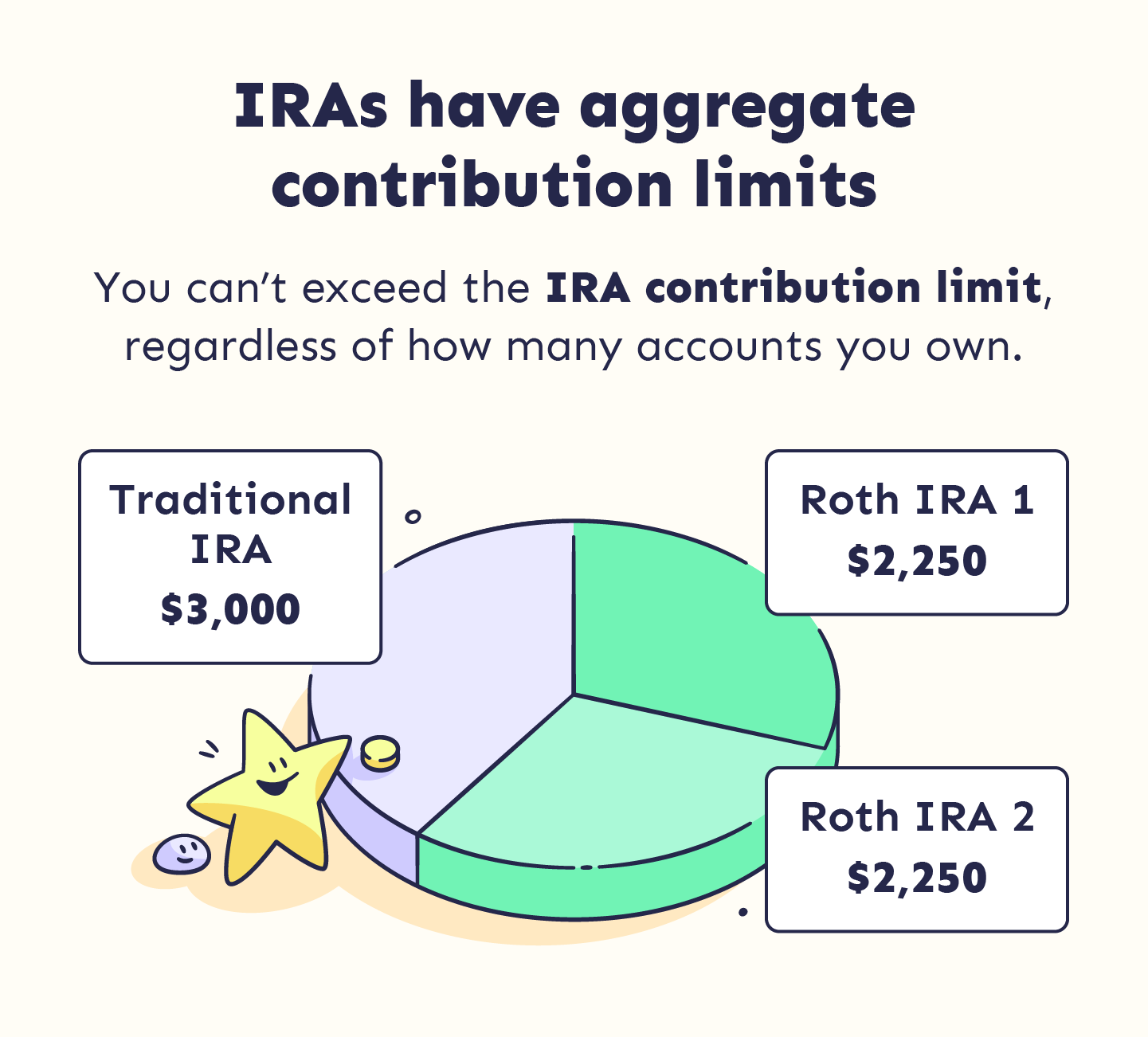

- Opening multiple IRAs doesn’t increase your annual contribution limit, which is cumulative across IRA accounts.

- Opening multiple Roth IRAs probably is not your best tax strategy. One traditional IRA and one Roth IRA are plenty for most investors.

Tax-advantaged accounts are great for two things: increasing your wealth via investments and reducing your tax liabilities. It’s what makes accounts like IRAs so attractive, but should you have multiple Roth IRAs?

It’s your life and your money, and you can have as many IRAs as you want, whether they’re Roth or traditional.

Multiple IRAs won’t do anything for your contribution limit (which is cumulative), but there are some investment and tax advantages. On the flip side, managing several accounts isn’t easy, and they can accumulate expensive fees. So opening more than a couple of IRAs likely isn’t that beneficial.

If you’re interested in maximizing your tax advantages with individual retirement accounts, learn more about when multiple Roth IRAs might help you and what you need to know first below.

How many IRAs can you have?

You can have as many IRAs as you like, but you can only contribute earned income. Some compensation limits may also limit your eligibility to contribute to Roth IRAs.

If you’re under 50, you can’t contribute more than $7,000 across IRAs in 2024, even if you own multiple types of accounts. If you earn above a certain income threshold, you may have an even annual lower limit.

In 2024, eligibility to contribute to Roth IRAs phase out at these income ranges:

- Single filers and heads of household: $146,000-$161,000

- Married couples filing jointly: $230,000-$240,000

- Married filing separately with a workplace retirement plan: $0-$10,000

This means your contribution limit is reduced if you make more than the lesser amount for the phase-out range, and you lose the ability to contribute if you exceed the range altogether.

So a single filer making $150,000 has a reduced contribution limit. If they get a raise placing them over $161,000 in 2024, they can’t continue direct contributions.

Rollovers

If you’re rolling over funds from a 401(k) or other retirement account into a traditional IRA, know that the actual rollover isn’t subject to contribution limits. So, for example, you can roll over $35,000 in one year and still make $7,000 in direct contributions to the same IRA.

The rollover amount doesn’t count because you’ve already enjoyed the benefits of contributing to the original tax-advantaged account. You won’t earn any additional deductions.

Keep in mind that if you convert assets from a traditional 401(k) into a Roth IRA, you do have to pay income taxes on that balance, but it won’t affect your annual IRA contribution limit. Traditional accounts use pre-tax dollars, and Roths accept after-tax contributions. So, you need to pay Uncle Sam to enjoy the Roth benefits.

Important Note: Your income and whether you contribute to a workplace retirement plan can impact your ability to earn a tax deduction for traditional IRA contributions. Make sure you understand the full implications of all of your retirement contributions to make the most of your tax strategy.

Benefits of opening multiple Roth IRAs

You likely don’t need multiple Roth IRAs, but there are some cool benefits if you know how to manage them. Here’s an overview of perks to think through:

1. Tax strategy optimization:

Traditional and Roth accounts offer different tax advantages, and mixing and matching these accounts can help you maximize both benefits.

- Traditional contributions are pre-tax, which reduces your taxable income and delays taxes until withdrawal when your income is likely lower, which means a lower tax rate.

- Roth contributions use after-tax funds, which is great if your income and tax bracket are lower now than you expect them to be by retirement. Returns also grow tax-free, and you can withdraw from your contributions anytime without owing taxes or penalties.

2. Investment diversification:

The more accounts you have, the more investment options you have to manage risk, target different goals, and reduce the impact of a specific investment or asset’s poor performance.

Multiple IRAs also give you flexibility in how you control your accounts. You might directly manage one account yourself while allowing a traditional broker or robo-advisor to manage other investments.

Playbook Tip: This is a great way to learn more about investing early on without risking too much of your retirement egg.

3. Contribution flexibility:

You can spread your contributions across accounts and adjust how much you contribute based on performance or financial goals.

You might regularly contribute to a low-risk account for consistent growth, while contributing a lump sum once or twice a year to another IRA that targets higher-risk investments.

4. Withdrawal flexibility:

Roth IRAs also allow penalty-free withdrawals from contributions, even before you reach retirement age. Early withdrawal penalties apply to other tax-advantaged accounts (with some exceptions, like buying a house), so multiple accounts give you options if you need to tap into quick cash and want to avoid penalties or taxes.

You can also access your Roth IRA earnings tax- and penalty-free if you’re at least 59½-years-old and have owned your IRA for at least five years.

5. Estate planning:

You can open multiple IRAs and name a different beneficiary for each. This simplifies inheritance and optimizes the tax implications for your beneficiaries by assigning IRAs based on their individual situations.

6. Backdoor Roth IRA:

Roth IRAs limit your contributions based on income, but you might be able to work around this by rolling over your funds from a traditional IRA into a Roth account. You will owe income taxes on the transferred funds, though. You can also use 401(k) funds to open a mega backdoor Roth.

7. Insurance protections:

The Securities Investor Protection Corporation (SIPC) insures up to $500,000 of your investments with a single firm should the firm go out of business. If your assets are large enough, it’s a good idea to diversify with IRAs across different firms so that you don’t exceed that protection and risk losing a chunk of your investments.

Playbook Tip: After-tax Roth investments are valuable if you’re early in your career. In this case, you’ll likely increase your income and be in a higher tax bracket by the time you start withdrawing for retirement.

The Playbook Take: If you want control over each of your retirement investments, multiple IRAs might be the way to go. But, the casual investor is well covered with just a traditional and Roth IRA account.

When you shouldn’t open multiple Roth IRAs

There are also some negatives to owning so many IRAs, Roth or otherwise. First, there’s no boost to your contribution limits since it’s a total limit across IRA accounts. So, it’s not a sneaky way to increase your after-tax savings.

But there’s more to consider before opening extra Roth IRAs:

- Managing your investment portfolio gets tricky when you have more than a few accounts. Tracking all accounts and their performance is time-consuming, and we don’t recommend it if you’re just getting started. If you want to open more accounts without the stress, you can hire a financial advisor to help you out. If you already have multiple accounts, you can consolidate them to simplify managing your portfolio.

- Fees increase as you open more accounts. Roth IRA providers may charge account maintenance fees, transaction fees, transfer fees, and more. Be sure to shop around and read the fine print before opening a new account.

- Increasing your Roth IRA contributions might mean you contribute less to your traditional IRA, which impacts your eligibility for some tax deductions. Only traditional IRA contributions earn tax deductions, so the extra Roth funds could cut into your tax savings.

How to choose

Opening a Roth IRA and a traditional IRA is a great starting place, but even that isn’t a must-have for some investors. Here are some things to think through before opening multiple accounts:

Are you eligible?

Roth IRAs

You might not qualify to contribute to a Roth IRA if your income is too high. This is based on your modified-adjusted gross income, and your ability to contribute ends if you make more than these 2024 limits:

- Single filers: $161,000

- Married, filing jointly: $240,000

- Married, filing separately: $10,000

If you can’t contribute to a Roth IRA outright, you might be able to convert a traditional IRA into a Roth to take advantage of the investment diversity and potential tax advantages.

Traditional IRAs

You can open multiple IRAs regardless of income, but income limits and 401(k) contributions impact your potential to take tax deductions for traditional IRA contributions. If you can’t maximize the tax deduction, it might not be super valuable to you.

Do multiple accounts support your goals?

Personal goals vary, and you might not need multiple IRAs to meet yours.

For example, if you have a lot of debt, paying that off first will improve your overall financial situation and allow you to increase investments in the future. If you’re unsure where you stand, work with an advisor to get a clear picture of your financial situation.

Does it reduce your tax liability?

At the risk of sounding like a broken record, not everyone qualifies for all IRA tax perks, and there are other tax-advantaged accounts to consider.

For example, maximizing a 401(k) with employer-match benefits might be a lot more valuable to you if you earn too much to enjoy traditional IRA tax deductions.

But you might look at your budget, compare the tax advantages of all of your investments, and then decide that opening multiple IRAs will help increase your portfolio diversity or reduce your overall tax bill.

Just make sure you understand why you want multiple IRAs to build the best strategy to reach your objectives. In many cases, less is more.

The Playbook take: Two IRAs (Roth and traditional) are plenty

The IRS has a lot of rules about IRAs, but none of them limit how many accounts you can have. We recommend sticking to two IRAs – one traditional and one Roth – to optimize your tax strategy.

If you read up on the advantages, consult an advisor, and decide to have multiple IRAs – enjoy!

It’s a good choice for some savvy investors who want more control over their retirement, particularly if they’re at the lower end of their lifetime salary expectations. But it can become an expensive hassle and won’t allow you to contribute more than $7,000 across accounts.

If you’re looking for an effective retirement strategy that maximizes your tax advantages, try Playbook.

.png)